Cost of equity refers to a simple concept- the required rate that common shareholder’s expect. Sadly, calculating it is one of the tougher things to do (you can view this as exciting because it’s tough if you’re a twisted individual like me 😉 ).

There are 2 ways to calculate this.

i) The Dividend Growth Model &

ii) The Security Market Line Model (SML)

Let’s discuss them briefly:-

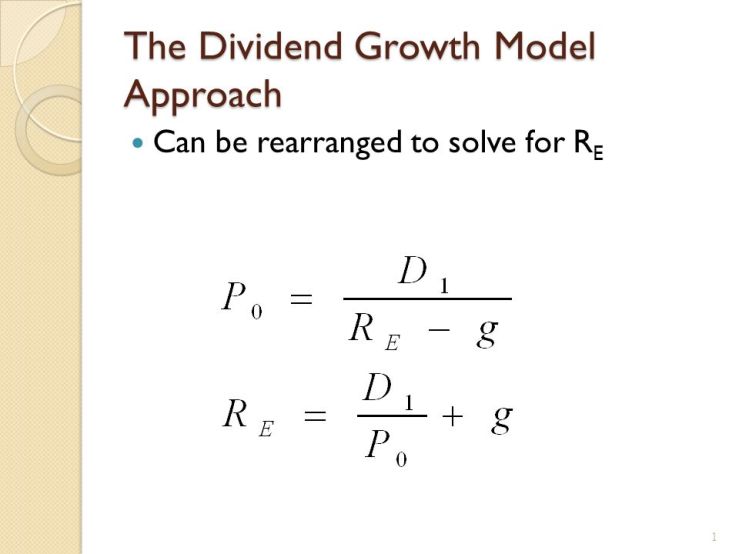

i)The Dividend Growth Model:

Here, Re is the cost of capital. D1 is next years projected dividend, Po is beginning stock price and g is growth rate.

Growth rate is the rate at which dividend is expected to grow next year.

D1 can be calculated by this formula:- D0*(1+g)

Good sides & Bad sides of using this method:

Good- It’s simple and easy to apply.

Bad-

Firstly, It depends on the company actually paying dividends (for at least 2 consecutive years) , but, not every company does that.

It also assumes that dividends grow at a constant rate, which is a lie too (usually).

Secondly, It does not explicitly consider riskiness of the security.

We can tackle these problem with the next model- SML which is discussed in the next post.